Gifts That Cost You Nothing Now

Gifts in a will or by beneficiary designation are two easy ways to unite our community and improve lives for years to come — and they don’t cost anything now.

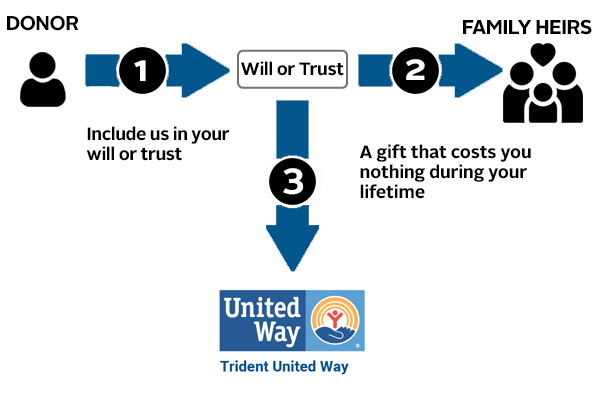

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for Trident United Way. Once you have provided for your loved ones, we hope you will consider making our mission part of your life story through a legacy gift.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

LASTING IMPACT

Your gift will create your legacy of changing lives in the Tri-County region for generations.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

NO COST

Costs you nothing now to give in this way.

Four simple, “no-cost-now” ways to give in your will

General gift

Residuary gift

Specific gift

Contingent gift

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to Trident United Way contingent upon the survival of your spouse.

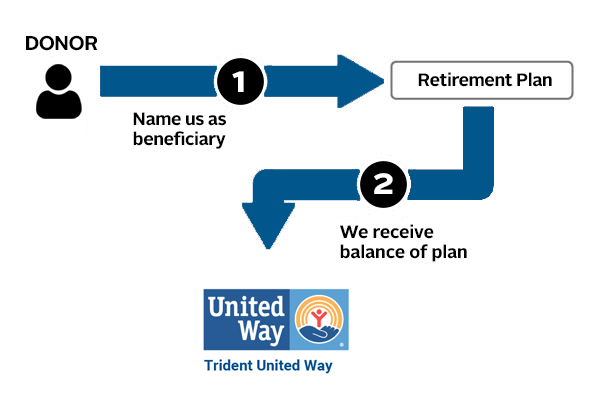

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bond, and more to use in helping individuals and families in our community — and it costs you nothing now.

By naming Trident United Way as a full or partial beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of creating lasting change.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now

Create your legacy with Trident United Way

Types of Gifts

Retirement plan assets

You can simply name Trident United Way as a beneficiary of your retirement plan to improve education, financial stability and health in our community.

Life insurance policies

You can name Trident United Way as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, Trident United Way will receive the proceeds of your policy after your lifetime. You can change your beneficiary at any time and may reduce your estate taxes.

Bank or brokerage accounts

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name Trident United Way (Tax ID: 57-0314378) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD) or a brokerage account. When you do, you’ll take a powerful step toward uniting our community to improve lives for generations to come.

Funds remaining in your donor-advised fund

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name Trident United Way as a “successor” of your account or a portion of your account value, you enable us to be a catalyst for measurable community transformation.

How to update a beneficiary designation:

Simply contact your bank, retirement plan administrator, insurance company or other financial institution to request a beneficiary designation form. You may also be able to log in to your account and update your beneficiaries online.

Please use our legal name: Trident United Way

Include our tax identification number: 57-0314378

Complimentary Gift Planning Resources Are Just a Click Away!